How to survive and thrive, no matter what the economy is like

Why some businesses thrive while others implode during economic downswings remains a puzzle to many business-owning entrepreneurs. Often, they mistakenly assume that all businesses must suffer through recessionary cycles. In reality, some companies are essentially recession-proof, and it’s not necessarily because they are bigger, better-known, or more generously capitalised. What really separates the successful enterprises from those that collapse during down cycles is they are organised around a uniquely dynamic and healthier approach to the business cycle.

They plan for the future, and they keep contingencies in place to confront whatever challenges might arise. They sell products and services that do not go out of fashion as easily. And most of all, they focus on profits in an intelligent manner that helps them grow and prosper in any economic environment.

Here are some ideas for creating a company that will successfully weather an economic downturn:

- Set, measure, and monitor inventory targets, sales goals, and revenues. But make profit – net profit – the main overriding focus.

- Weed out unprofitable accounts and lack luster ventures, services, and products.

Reward top performers, and either improve those who are not contributing or let them go for the benefit of the overall team. - Keep in close touch with customers and track their demographic patterns and consumer preferences. The better one knows his or her customers, the better one understands their own business.

- Develop strategies to attract new customers, retain existing customers, and sell more products or services to each and every customer. Grow the customer base, but also grow net profits in order to capture tangible bottom line benefits.

- Advertise and market aggressively, but constantly refine and redefine the campaigns to strengthen the business and enhance the equity of the brand name to give it greater power, meaning, and recognition.

Planning Ahead Means Getting Ahead

Once a company starts losing its bearings and gets carried away by stormy economic tides, it is difficult to get safely back to shore. When economic conditions become adverse, those who were barely afloat sink, those treading water drown, and those without a fixed compass get confused and lose their connection to their primary customer demographic. To avoid these effects, it is important to prepare ahead of time for the eventuality of downward market cycles.

According to a January 2008 article published in BusinessWeek, market measurements and forward-looking financial indicators are important tools. Without them, business owners may never see hard times coming. Many times, their cash reserves are wiped out without warning. While no business leader has a crystal ball, those who employ simple, easy to read tools for testing and evaluating performance are in a stronger and more informed position. They can sooner identify trends and more quickly adjust and adapt to changes, which gives them a tactical and strategic advantage over their less informed competitors.

Rather than simply shooting in the dark, those who have the proper tools can find targets and hit them. When profits begin to drift downward, they can realign their focus to hone in on them in a more precise and accurate manner, allowing them to get back on track to profitability. Those who do not respond proactively to changes are at risk for not only wasting time and money, but also losing their valuable customer base and overall brand integrity.

*The difference between response and reaction generally boils down to deliberate preparation, prior planning, and intentional action.”

The Critical Difference between Response and Reaction

Coaches often talk about the need to remain calm and aware under duress, so that instead of simply reacting in a random and haphazard fashion, one can respond with more levelheaded and effective behaviours. If you have adequately trained and sufficiently practiced to meet a set of challenges, responding to adverse conditions is often relatively easy and successful. But reacting to situations you are not prepared for frequently leads to knee-jerk actions that are neither thoughtfully conceived nor efficiently executed.

The difference between response and reaction generally boils down to deliberate preparation, prior planning, and intentional action. This stands in stark contrast to simply doing something from a place of fear or panic. Emergency response organisations, for example, drill and train for the inevitable. When a fire erupts or a traffic accident happens, firefighters and police officers typically view the situation as another day at the office, because they have planned in advance to react in an intelligent, effective and professional manner. They have the resources on hand, they understand how to best deliver them, and they confront the situation from a position of strength, not in a weakened state of distress.

One of the interesting things about response versus reaction is that once one reaches a certain level of training, instinctive behaviours transform from reactions into responses – and from reactionary to responsible. The first time a new quarterback enters a professional game, it can be a harrowing and clumsy experience. But after some time and a little bit of repetitive practice, flawless responsiveness becomes instinctual and subconscious. The blur of defensive linebackers rushing forward no longer inspires panic, but instead indicates openings downfield that can be exploited for more yardage or a score. The quarterback begins to respond positively under pressure, because that environment produces energy and insight.

Similarly, when a business is planned with proper contingency solutions in mind, it can avoid missteps and bad judgements while capturing a greater market share. Experiencing an economic downturn only makes it stronger – by allowing it to put into action the concepts that it has been practicing all along, it refines and strengthens its approach. Meanwhile, the weeding out of weaker and less capable competitors puts it in an advantageous position once the economy strengthens.

Choose Products and Services with Care and Attention

As Brad Sugars, founder of one of the world’s most successful franchise organisations explains, if he had lived during the era of the famous California gold rush, he would not have chosen to follow the masses in search of elusive gold. Instead, he believes, it would have been easier and smarter to set up a roadside stand and sell tin pans. That idea sounds completely counterintuitive, but those who think against the crowd and buck the trend often emerge much more successful and prosperous than their peers.

Let’s consider the historical facts. While only a small percentage of prospectors actually struck it rich, 100 percent of them bought at least one pan in order to help them sift through mud in search of the precious metal. Those who supplied the tools of the trade made plenty of money because they did not have to worry about creating the market for their product. They simply and cleverly identified a niche and filled it. By doing so, they fulfilled their entrepreneurial dreams while customers sought them out.

Indispensable Businesses are Recession-Proof

The biography of the businessman behind the legend of Johnny Appleseed tells a similar story. While most people believe that the apple-sowing mendicant was a fictional character, the truth is there was a real person upon whom the Johnny Appleseed folklore and mythology is based. John Chapman was his name, and biographer and historian Robert Price chronicled his business life in a book published in 1954.

Chapman was, for all intents and purposes, one of the first franchisers in the USA. Although myth describes him as someone who simply walked around randomly planting apple trees, he actually created a carefully conceived business model that was absolutely recession-proof. Upon his death in 1845, he owned more than 1,200 acres of prime real estate. This was because he found both a product to sell and a way to deliver it to customers that was unique, ingenious, and profitable.

Frontier settlers needed sugar, but it was prohibitively expensive. A more affordable substitute was sweeteners made from apples – what we refer to today as fructose. In addition, apples were also a valuable foodstuff by themselves. But apple trees were few and far between in the wilderness of North America. So Chapman would go deep into the frontier, plant an orchard, and then – as the settlers arrived – he would sell the young trees to them. By establishing these frontier tree farms or nurseries across the USA, he ensured a strong demand for his product. He didn’t even have to deal with labor intensive apple cultivation and harvesting – he just sold young trees that grew easily in the fertile frontier soil.

His overhead was tiny, because he would use the seeds of one tree to grow dozens of others in a true franchise spirit. Each sapling he sold brought a good price. Even though settlers had no extra money, they considered the purchase of a healthy tree to be a wise long-term investment. And according to many land grant laws that were intended to discourage real estate speculation, land owners were required to plant a minimum number of fruit trees on their homesteads. So Chapman had a product that people not only wanted, but were also required by law to have. Highly motivated customers came to him by word of mouth.

In order to keep moving, branch out, and stay ahead of the national migration of his customers, Chapman decided to hire people to manage his orchards in his absence. He would go somewhere, start a new nursery, and then hire and train a local person to run it and bank the profits which he shared with them. Eventually, Chapman had an entire network of nurseries that were paying him dividends. Towards the end of his life, he moved back to his native Ohio and retired as a very wealthy man, while the money kept rolling in from his national orchard business.

When he first began to trade he was in poverty, but by the time he died his business was worth millions in today’s inflation-adjusted dollars. His business was indispensable, and people sought him out to buy his products. In short, he had an exemplary business model.

When an employee becomes indispensable to a boss, they ensure that they won’t be fired, and will be first in line for a promotion. Similarly, those businesses that become essential and irreplaceable to their customers thrive with longevity, while other companies tread water and eventually succumb to red ink.

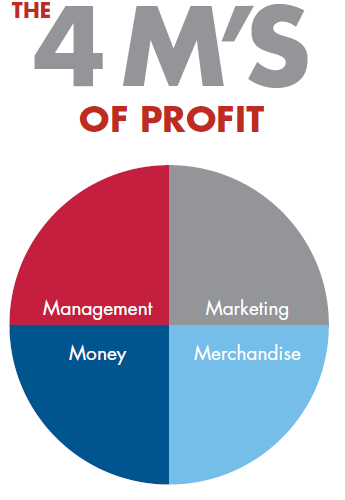

The Four M’s of Profit

Even a brilliant business strategist like John Chapman will fail without profit, and preserving profits when economic conditions aren’t good is essential. Adherence to the “Four M’s of Profit” can help guarantee success even when times are tough.

They are as follows:

Management

Profitable companies are well managed. Managing a business effectively requires a blueprint for employee and team training, a current and useful database of contacts, leads, and customers, a good budget and strong accounting practices, and skilful use of time and resources.

Profitable companies are well managed. Managing a business effectively requires a blueprint for employee and team training, a current and useful database of contacts, leads, and customers, a good budget and strong accounting practices, and skilful use of time and resources.

Intelligent manages know how to systemise routine procedures while humanising the exceptions. As an example, while customer services systems should be consistent and follow written guidelines and rules, customer service also relies upon well-trained humans to spontaneously solve the problems that are unexpected or out of the ordinary. They do so by understanding the core values of the company and internalising those to beneficially represent the business under all circumstances.

Money

Strategies for dealing with money will make or break profitability. A successful approach to managing money will involve several key components. Those include auditing costs and setting budgets that are understood and followed by everyone in the business. Next, margins need to be increased – even if only gradually – in order to fatten profits. By keeping prices stagnant the average business will begin to lose money automatically, just because of the demands placed on money by ordinary annual inflation. A better approach is to proactively raise prices, concentrate on enhanced customer service to justify the increases, and in that way dramatically boost net profits without alienating customers. Discounts and giveaways should be discontinued, but replaced with profitable programmes such as in-house financing and credit card acceptance to make it easier for customers to buy and pay for their purchases.

Marketing

Marketing should be not so much about selling, but more about buying. Marketing of products and services is too often done solely from the perspective of the seller, rather than the buyer or customer, and those marketing campaigns seldom work. Those businesses that focus on marketing as a form of customer service will tap into the needs and desires of their targeted audience in a way that translates more easily into increased business and revenue.

Customer-centric marketing revolves around offering real value, but it also involves strategies like “upselling” to customers. They buy a deluxe model versus a standard model, for instance, and pay a premium in order to enjoy bigger benefits from the upgrade. Another example is “cross-selling” – where a company sells other products to enhance the primary purchase. Rather than just buying the burger, for example, the customer also buys fries and a soft drink to go with it. A third example is “down-selling,” which works well when a customer might otherwise not buy anything. Accommodate their budgetary demands and make a customer for life, rather than trying to sell them what they can’t afford and losing them to a competitor.

Merchandise

Taking a top-down or macro view of business merchandise can be a valuable exercise for a business owner, because the products and services sold help both define the entire business model as well as guide the direction of sales and revenue. When given a choice between one item of merchandise and another, look at the potential profit margins and choose the one that delivers the most profit.

Sales of computer printers, for example, slowed down after most consumers bought one, because they do not need to be replaced very often. However, ink has to be replaced continually, which is why most manufacturers focus on selling ink rather than printers. They will practically give away a printer just to snag a customer who will have to return again and again to buy ink refills. In other words, these printer manufacturers used to be in the printer business, and they sold ink to promote that product. Now they are in the ink business, and they sell printers in order to support their new business model. All the while they are making profit by knowing where it comes from and how to nab it.

Identify which products are profitable, and focus on selling those. Other ways to manage merchandise include stocking only higher priced and faster-moving items in the inventory, selling exclusive lines that others don’t offer, and carrying private label merchandise. Selling only quality merchandise – and making that part of an overall brand identity – is always a wise approach, and it can generally deliver higher margins because people pay more for prestige, status, and excellence.

Wallet Share versus Market Share

One often-overlooked aspect of the modern business world is that chasing market share can mean running around in circles and getting nowhere fast. While some businesses put all their stock in capturing market share, many of them wind up losing their share of profits in the process. The conventional paradigm is that companies are in business to buy products and resell them to customers. But looking at this idea from a different point of view may help clarify the essence of market share and how it relates to pure profitability.

Switch the idea around and view the goal of the company as buying not products, but customers. In reality, every company has to pay to attract customers through marketing and advertising, and by looking at it from this different perspective it is easier to see that. Rather than chasing market share, businesses are chasing “wallet share” or profit. After having invested so much to earn the loyalty of a customer, it is critical to focus on getting a solid return on that investment. In other words, once a company has customers, it needs to take full advantage of the opportunity that each customer represents.

“In other words, once a company has customers, it needs to take full advantage of the opportunity that each customer represents.”

Building Upon Success to Grow Profits in Any Cycle

Lots of business owners exhaust both themselves and their resources trying to increase sales, only to wind up with smaller profits at the end of the day. Profit is the king in any business, and those who lose sight of that fact suffer, especially when profits get pinched by a recession or industry slowdown. Don’t counteract a downturn by expending more wasteful energy. Instead, put it where it really pays off the most. That means increasing the conversion rate, the number of transactions, and the margins of each sale. Using your resources more effectively will go a lot further in increasing your profit margins than merely tossing time and energy at the problem.

Generate more leads by doing more advertising, getting more exposure through publicity, and by targeting those who are the best potential customers. Use referral incentives, because an existing client who advocates on behalf of a business is the best advertiser of all. Then concentrate on converting those leads into paying customers by offering better products and superior customer service. People still spend money when times aren’t good, but they are more careful to pay for value and get their money’s worth. By offering that kind of quality, a business will succeed and grow stronger, not weaker, during downward economic cycles.

Meantime, focusing on margins by spending wisely and running an efficient and goal-oriented business will feed profits and strengthen the bottom line.

Cash is King in a Recession

They say that “cash is king during a recession,” and many of the great business success stories tell of companies that expanded and grew because they made lucrative investments during hard economic times. NationsBank – now Bank of America – bought one of the largest banks in the nation at a bargain basement price during the banking recession of the 1980s. By doing so, it transformed itself from a substantial regional player into one of the top three financial institutions in the USA.

But it was able to make that strategic acquisition because it had cash on hand to spend and invest, while other banks were struggling to maintain operating capital. Buying low and sell high requires purchasing and acquiring while others are selling and unloading, and businesses that are recession-proofed can do so to emerge from an economic downturn even more energised and poised for profitability.

The key to taking advantage of the “cash is king” maxim is to first and foremost understand that “profit is king” in business. Focus on profitability, and every other aspect of a business will essentially take care of itself as the business model lines up accordingly. In good times and bad, businesses that follow superior plans and models grow – and so do their profits.